money market vs mutual fund

Choose From Over 70 Funds With 4 5 Star Ratings From Morningstar. Ad Mutual Funds Retirement Investing Solutions.

Etf Vs Mutual Fund What S The Difference Ally

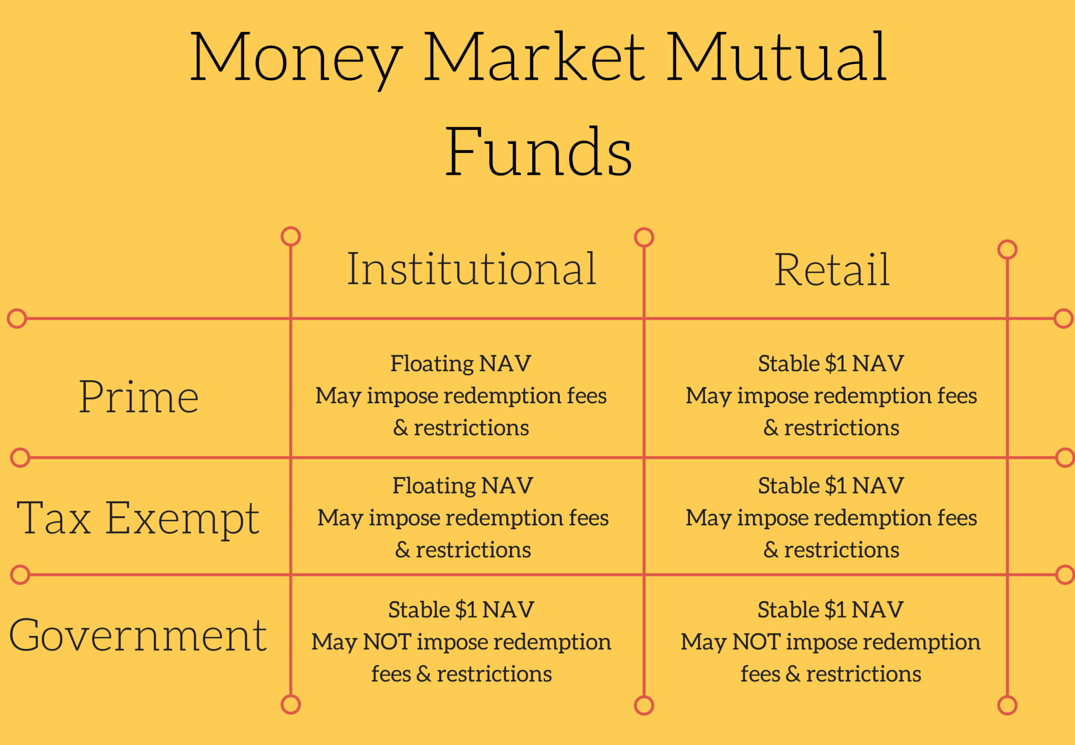

A money market mutual fund or simply money market fund is a type of fixed income mutual fund.

. Money market mutual funds are not FDIC insured. Ad View the Highest Interest Fee Free Money Market Accounts. Securities and Exchange Commission by law mutual funds must invest in low-risk securities.

Download the app today. Money market funds and mutual funds are closely related with money market funds essentially being the safer. When to choose a money.

MMAs can also be called money market savings or money market deposit accounts and they differ from money market funds which are a type of investment. Thats the Greenlight effect. The biggest difference is that yields on money market mutual funds respond much more rapidly to changes in market interest rates.

It holds a basket of securities that generate the gains and losses investors experience as shareholders. The most important difference between a money market account and a money market fund is that the first is a risk-free deposit and the second is an investment product that. Mutual funds and money market funds are both pools of money invested by professional money managers but a money market fund invests only in low-risk short-term debt.

They are considered one of the safest investments. The government does not insure money market mutual funds. As stated before all money market accounts mature in one year or less.

MMFs are mutual funds that invest in short-term debt like Treasury notes CDs and. Mutual Funds The Basics. Money market mutual funds are among the lowest.

Ad The money app for families. Ad Quickly View the Current Savings Rates for Free at Bankrate. Money market funds are not appropriate for individuals that are seeking an investment that is likely to significantly outpace inflation.

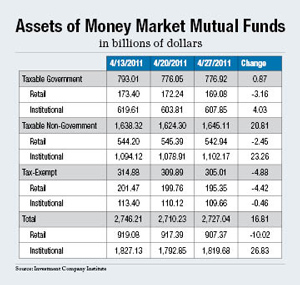

The top-yielding money market accounts currently pay in excess of 05 percent interest while the average bank is paying just 006 percent. A money market fund is like other mutual funds. A money market fund is a low-risk and highly liquid investment asset specifically a mutual fund while a money market account is a type of deposit account.

In other words these funds typically invest in high quality translation. Side-by-Side Comparison of Updated Rates to Ensure the Best Return on Your Investment. However according to the US.

Money market funds are fixed income mutual funds that invest in debt securities characterized by short maturities and minimal credit risk. A money market fund MMF is one alternative to money market and savings accounts. Learn About Our Approach.

This time-frame contrasts from a mutual fund which enables an investor to hold or sell the investment. Side-by-Side Comparison of Updated Rates to Ensure the Best Return on Your Investment. Money market mutual funds also known as money market funds are fixed-income mutual funds that invest in high-quality short-term debt.

Money Market Funds vs. Ad Quickly View the Current Savings Rates for Free at Bankrate.

Money Market Mutual Funds Youtube

Money Market Funds Key Facts And Figures Consilium

Money Market Learn About Money Market Instruments And Functions

Why Hold Money Market Mutual Funds Articles Consumers Credit Union

Stock Talk Stocks Vs Mutual Funds Stock Shock

Finding The Best Money Market Mutual Funds What You Need To Know About Money Mutual Funds Rates Of Return Advisoryhq

0 Response to "money market vs mutual fund"

Post a Comment